Weakening demand from China and a surplus of ships led to the worst in the industry downtrend over the past 30 years, lowering the Baltic Dry Index, which reflects the cost of transport of dry cargo by sea, twenty main trade routes, to a record low.

The Chinese company Winland Ocean Shipping Corp. filed Feb. 12 documents on protection from creditors under bankruptcy law in the United States, the second case of bankruptcy this month. Due to current market conditions, the financial position of the company and its subsidiaries had deteriorated, leading to difficulties at the moment, according to the company.

Private Copenship Danish company filed for bankruptcy in early February after the losses suffered in the dry cargo market.

The combination of lower demand for steel in China and the large volume of new vessels causes panic and creates a worse situation in the market of dry cargo shipments since the mid-1980s, officials said the Hong Kong carrier Courage Marine.

China’s imports fell by 19.9% compared with the previous year, as the economy slowed the growth to the rate of observed 24 years ago.

The current freight rate for the transport of coal freighter Panamax class from Indonesia to South China is about $ 3,000 per day compared to $ 6,000 last year. The index value of dry cargo shipments slumped by nearly two thirds in the last 15 months.

Growing fleet worsens slowing demand, the number of class ships Capesize and Panamax, ordered transport companies for the next three years, representing 39% of the existing fleet, the carrier according to Clarkson. However, shipping dry cargo increased by only 4% in the past year.

As a result, dozens of ships and Sapesize Ranamax idle in Singapore, Hong Kong and the coast of South Africa.

Bulk carriers are not the only victims. More than 10% of the world fleet of LNG tankers carrying liquefied natural gas, now left without work after the Asian LNG prices have fallen by almost two-thirds since February 2014.

Similar Posts:

-

Air Cargo Report And Outlook From the International Air Transport Association

What Is The Trend For Global Air Freight Markets? The International Air Transport Association (IATA) released data for global air freight markets showing air cargo growth accelerated in May, with 4.7% -

Shipping: The Giants War Results

COSCO As a result of an oversupply of vessels in the industry, the global shipping market is unlikely to see a recovery during the next two years, according to the chairman -

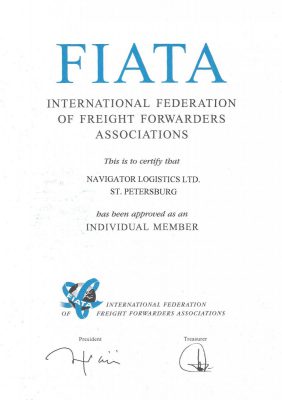

Freight transport – partners

TKS.RU – all about customs. Customs for everybody – customs portal of RF Association of International Automobile Carriers Portal RR Partner Logistics Logistics — scienсe information business portal CARRIAGE OF CARGO BY SEA People have been