If in the process of international transportation, it has become necessary to carry the goods delivered from abroad over the territory of Russia from the place of their arrival to the customs authority where declaration will be performed, then we have faced the situation regulated by law and called domestic customs transit (ВТТ).

In accordance with the RF Customs Code such transportation is carried out without payment of customs duties and taxes, and prohibitions and economic restrictions established by the law on state regulation of international trade activities are not applied to the goods.

There are other situations where Domestic customs transit is applied:

when transporting cargo (for example, products of processing of foreign goods) declared at the customs post in the Russian hinterland to the customs authority in the place of cargo exportation outside the RF;

when transporting undeclared foreign cargo between warehouses of temporary storage (for example, due to temporary storage warehouse liquidation) or customs warehouses;

in other cases, when it becomes necessary to transport foreign cargo which is not provided with security of customs duties payment.

The procedure of domestic customs transit is not applied:

if cargo is transported by pipeline or by power lines;

if the aircraft performing a scheduled international flight made an intermediate or forced landing in the customs territory of the RF and unloading of cargo (even partial) is not carried out.

To effect domestic customs transit the carrier or the forwarder (if he is a Russian) or the consignee is to receive a permit for transportation by the customs authority located in the region where the transportation begins if he effects operations with it outside the region where the customs authority is located.

This being the case the following conditions are to be fulfilled:

the goods being transported are not to be prohibited for import, they are to undergo border, sanitary, veterinary and other necessary controls, have all permit and/or licenses for transportation in Russia;

transit declaration for the transported goods is to be provided;

identification of goods is to be carried out;

transport is to be specially equipped for transportation of sealed cargoes;

payment of customs duties and taxes is to be secured.

The last condition is not mandatory if customs convoy is provided or cargo transfer is performed by the customs carrier.

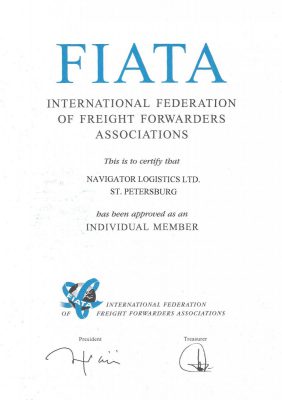

Navigator Logistic Company has a considerable experience in delivery of cargoes on terms of domestic customs transit. We always fulfill conditions of domestic customs transit required by law that is why we obtain respective permits without difficulties.

Be sure:

we’’ll deliver cargoes and their documents to the required place following the stated or fixed routes in the cases specified by the Customs Code;

time of delivery won’t exceed terms specified by the customs authority of departure;

when using customs means of identification (stamps, seals and etc.) we guarantee their security;

when it’s necessary to perform cargo handling operations – loading, transhipment, unloading or other – we’ll obtain respective permits of customs authorities for their execution.

It’s important to remember that transhipment of goods transported on terms of domestic customs transit from one transport to another can be performed without such permit. If it’s possible to perform transhipment without damage of applied seals, stamps and other customs means of identification it’s enough only to notify the customs authority of execution of such transhipment operation. As a rule, it’s possible when standardized containers and specialized means of their delivery and loading-unloading are used for transportation.