In the context of linguistics the term “customs import” is a semantic pleonasm. It is redundant because import is bringing foreign goods into a country without obligation for reverse export. This means that goods imported to Russia (in everyday life they are also often referred to as “import”) will pass the customs procedure of “release for internal consumption” on the border. Therefore, import will always be “customed” whereas “uncustomed” import is smuggling.

Yet this term has become frequently used meaning imported goods going through customs procedures and many participants of foreign economic activity are looking for such a service.

All customs operations are performed in the special customs authority where the importer of goods is registered. The main operations are: registration of the cargo declaration (assignment of a customs number to it), check of cargo documentation, control of its declared customs value, levying of duties, VAT, excise and customs fees and other statutory payments, customs inspection and release of goods. The last action of the customs authority allows those who are interested to use imported goods in accordance with the declared customs procedure.

For calculation of payments by the declarant the customs value of goods is to be determined. Customs official controls the declared customs value. According to the results of examination the following decisions can be made: either to accept customs value declared by the declarant or to make necessary corrections (in case any signs of unreliable or insufficient information are detected).

If the declarant refuses to change the customs value, customs officials have the right to set it by themselves asking the importer for additional documents and details clarifying the terms of sale of the goods that had impact on the price of transaction.

If the importer does not take any actions (no change of value, no responses, etc.) within 10 days from the date of declaration registration, the customs authority has the right to refuse the release the goods.

For the release of goods for internal consumption it is necessary not only to effect correctly all payments but also the goods are not to fall under current prohibitions and limitations as well as they are to correspond to all measures of non-tariff control.

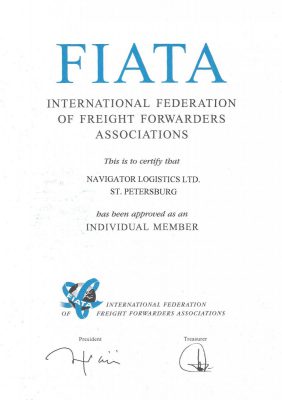

It is plain that to go through all customs formalities correctly it is necessary to be a specialist in this field and have extensive experience in the customs clearance of imported goods. Entrust delivery of goods and execution of all these operations to Navigator Logistic Company – and you may not worry about your “customs import”.