– is a document intended for the declaration in writing or electronic form of goods transported across the customs border of the state during export or import.

CCD is issued by the manager of the goods and certified by the customs inspector, in the future serves as the basis for passing through the border.

The declaration contains information about the cargo, its customs value, the means of delivery, the sender and the recipient.

It is issued on the forms of the established form “Transit Declaration (CD1 and CD3)” (main sheet) and the form “Additional Sheet (CD2 and CD4)” (additional sheet).

The CCD is the basis for paying for goods when importing to a supplier and receiving money from a buyer when exporting goods. The CCD is filed in the currency control of the bank where the transaction passport is open.

General provisions related to the filling of a Cargo Customs Declaration:

Cargo Customs Declaration is a set of four sheets CD1 (main sheet) and CD2 (additional sheets) – when imported into the customs territory of the Russian Federation.

And a set of four sheets CD3 (main sheet) and CD4 (additional sheets) – when exported from the customs territory of the Russian Federation. Information on goods contained in one consignment, which are placed under the same customs regime, may be declared in one CCD.

The sets CD2 or CD4 are used in addition to the sets CD1 or CD3, respectively, if information on two or more products is declared in one CCD.

In each of the sets of CD2 or CD4 information about three products can be declared. The number of sets CD2 or CD4 used in declaring a batch of goods is not limited.

One consignment is considered:

- When importing goods into the customs territory of the Russian Federation: goods transported from the same sender to the same recipient in the customs territory of the Russian Federation for the fulfillment of obligations under one agreement concluded during a foreign trade transaction (or one permit for processing goods with declaration of processed products), or on a one-sided foreign trade transaction, or without a transaction, and if the goods are within the time limits provided for in Article 129 of the Customs Code of the Russian Federation appeared to the same customs authority at the place of arrival on the customs territory of the Russian Federation or at the place of delivery (if the internal customs transit procedure was applied) and are (were) temporarily stored at the same place, if the temporary storage procedure was applied to the goods declared or issued within the deadlines established for the filing of the CCD in accordance with article 150 of the Customs Code of the Russian Federation;

- When exporting from the customs territory of the Russian Federation: goods simultaneously shipped (or shipped within a certain period of time when applying a periodic or periodic temporary declaration) in the region of activity of the same customs authority by the same consignor to the same recipient located outside the customs territory of the Russian Federation, towards the fulfillment of obligations under a single agreement concluded during a foreign trade transaction (or one permit for processing goods declaration of processed products) or by the unilateral foreign economic transaction, or without making any transaction;

- When moving by pipeline or power lines: goods moved by the same person for a certain period of time in order to fulfill obligations under a single contract concluded during a foreign trade transaction, or under several foreign trade contracts (including different delivery terms, pricing and payment) when submitting a temporary CCD;

- When modifying or completing the previously declared customs regime without moving goods across the customs border of the Russian Federation: goods placed under the same prior customs regime under one contract, if the relevant contract was concluded when performing a foreign trade transaction (or one permit for processing goods), under the customs control of the same customs authority or issued within the deadlines set for the filing of the CCD in accordance with article 150 of the Customs Code of the Russian Federation, the declarant which will be the same person who placed the goods under the previous customs regime, or the person who acquired property rights to the declared goods after they are placed under the previous customs regime.

- If goods contained in one consignment are declared for placement under different customs regimes, separate CCD must be submitted for each customs regime.

- When declaring currency and securities, a separate CCD is filed for each type of currency and securities.

- When declaring cash currency moved across the customs border of the Russian Federation in connection with the sale of goods on boards of aircrafts, as well as on railway and other types of transport (revenue and exchange currency in the form of banknotes and coins), a periodic customs declaration can be applied.

Set CD1 or CD3 is used to declare information about a single product. At the same time, goods of one name (trade, commercial name) are declared as one commodity and are contained in one consignment, assigned to one classification code according to the Commodity Nomenclature of Foreign Economic Activities of the Russian Federation (FEACN of Russia) and to one code according to the classifier of additional customs information (if in relation of the declared goods such a code is set), originating from one country or from the territory of one economic union or community, or whose country of origin is unknown, to the same conditions are applied for customs-tariff regulation and the application of prohibitions and restrictions, the size of rates of duties and taxes.

The goods specified in Appendix No. 1, placed under the customs regime of release for domestic consumption, are declared as one goods, if in addition to the conditions listed in the previous paragraph, the goods have one trademark, brand, model, article and have the same technical and (or a) commercial characteristics.

The CCD should be filled out using printers, legibly, not contain erasures, blots and corrections.

CCD must be filled out in Russian. Information used to individualize goods (trademark, article, model, etc.), as well as delivery condition codes, vehicle numbers, flight numbers, document numbers, and alike information, are indicated in the original language, including using the letters of the Latin alphabet.

When filling the CCD, an electronic copy is formed. At the request of the declarant the declarant can receive at the customs authority at no cost a software product that allows to fill the CCD and generate an electronic copy, or the customs authority provides a special computer on which the necessary software products are installed. In some cases, information in the CCD may be entered in capital block letters by hand, if the declaration of the goods with the filing of the CCD by the regulations of the Federal Customs Service of Russia does not establish the requirement to generate its electronic copy.

Details on all the mandatory points for filling out all four documents and copies you can read on the website “Slovarius”

Over there you may also download electronic forms for filling the CCD.

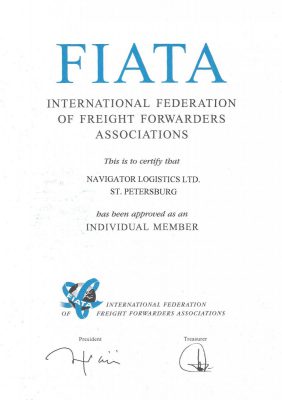

LLC “Navigator Logistics “offers services for execution of the CCD for customers from any location in Russia.